Document # GF-20170117-01V2.0

Department of Administrative Services

DOCUMENTATION

This document is “unclassified for official use only”. It has been developed by HSFA’s Governance and Finance Committee and is maintained by HSFA’s Department of Administrative Services (DOAS) on behalf of the Board of Directors, Office of the President, Secretaries of Public Safety, Energy Security and Health and Human Services in accordance with the organization’s best practices, bylaws, and its guidelines and policies and procedures manual in compliance with local, state and Federal law.

| Document Number | GF-20170117-01V2.0 |

| Revision Number | 8 |

| Audience | Applies to all HSFA Directors, Officers, staff members, volunteers, sponsors and community partners. |

| Created by | HSFA Department of Administrative Services (DOAS) |

| Created | 1/31/2017 6:55 PM |

| Last Updated | 1/31/2017 7:22 PM |

GF-20170117-01V2.0 HSFA Policies and Procedures Manual

Introduction

The HSFA Policy and Procedures Manual (“Manual”) is a formal body of documentation that defines and clarifies HSFA’s policies and procedures. Policies are the governing “rules”. Standard Operating Procedures (SOP’s) represent the implementation of the governing policy. SOP’s are a road map, a “how to” document. The Manual also contains Primers and Statements. These are educational in nature and provide detailed information on the laws, rules, and regulations that are the foundation of the policy.

Under HSFA’s adopted Governance, Risk Management and Compliance (“GRC”) framework, policies and procedures are to be adhered to and complied with at all times by all directors, officers and employees. Failure to do so could result in appropriate disciplinary action, including termination.

HSFA’s Policy and Procedure Manual is owned by the Board’s Governance and Finance Committee. The policies and the associated documentation are owned, managed and administered by HSFA’s Department of Administrative Services (DOAS) or parties designated by the board.

Policies must be written utilizing the adopted Policy Template which is included with the Manual. Other documentation (i.e., SOP’s) may be in any format. Policies require approval of the Board of Directors. SOP’s do not require such approval. To submit a policy for inclusion in the Manual, contact the Department of Administrative Services (see contact information below).

Document Version History

Use the table below to provide the version number, the author implementing the version, the date of the version, the name of the person approving the version, the date that particular version was approved, and a brief description of the reason for creating the revised version.

| Version # | Author | Revision Date | Approved By | Approved on | Reason |

| 1.0 | Jim Yokum | September 2009 | First Version | ||

| 2.0 | Connie Lerner | 31 January 2017 | Grammatical Errors | ||

DEPARTMENT OF ADMINISTRATIVE SERVICES (DOAS)

The HSFA Department of Administrative Services (DOAS) provides support for all areas of human resources administration from volunteer services to staff support and benefits administration.

Alpharetta, GA 30005

EIN: 14-1855787

Document No. GF-EP-G10051 - Terms and Conditions Statement

By using the pages in this site and/or other materials (collectively, “materials”) of The Homeland Security Foundation of America (“HSFA”), you agree to these terms and conditions. If you do not agree, you should not use them. These terms and conditions may be changed or updated from time to time. HSFA can revise these terms and conditions at any time by updating this document.

PERMITTED USE

Except as otherwise indicated, with respect to a particular portion, file, or document, any person is hereby authorized to view, copy, print, and distribute materials and documents of HSFA subject to the following conditions:

- Such materials may be used for informational, non-commercial purposes only.

- Any copy of the materials or portion thereof must include the HSFA copyright notice.

- HSFA reserves the right to revoke such authorization at any time, and any such use shall be discontinued immediately upon notice from HSFA.

Copyright © The Homeland Security Foundation of America. All rights reserved.

If you have any questions about this authorization, please contact HSFA at:

Alpharetta, GA 30005

EIN: 14-1855787

Restrictions and Limitations of Liability

HSFA will not be liable for any damages or injury caused by, including but not limited to, any failure of performance, error, omission, interruption, defect, delay in operation of transmission, computer virus, or line failure.

The use of these materials is at the user’s sole risk. Under no circumstances, including but not limited to negligence, shall HSFA be liable for any direct, indirect, incidental, special or consequential damages, even if HSFA has been advised of the possibility of such damages. The user specifically acknowledges and agrees that HSFA is not liable for any conduct of any user.

These materials may contain advice, opinions and statements of various information providers. HSFA does not represent or endorse the accuracy or reliability of any advice, opinion, statement or other information provided by any information provider, any user or any other person or entity. Reliance upon any such advice, opinion, statement, or other information shall also be at the user’s own risk. Neither HSFA, nor any of its respective agents, employees, information providers or content providers, shall be liable to any user or anyone else for any inaccuracy, error, omission, interruption, deletion, defect, alteration of or use of any content herein, or for its timeliness or completeness, nor shall they be liable for any failure of performance, computer virus or communication line failure, regardless of cause, or for any damages resulting therefrom.

Further, these materials may be linked to other sites and materials that are not maintained by HSFA. HSFA is not responsible for the content of those sites. The inclusion of any link to such sites does not imply endorsement by HSFA. HSFA makes no representations whatsoever about any other materials or sites which may be accessed through via HSFA materials.

Submissions

All remarks, suggestions, ideas, graphics, or other information communicated to the HSFA (collectively, the “submission”) will forever be the property of HSFA. HSFA will not be required to treat any submission as confidential, and will not be liable for any ideas for its business (including without limitation, product, or advertising ideas) and will not incur any liability as a result of any similarities that may appear in future HSFA operations. HSFA will be entitled to use the submission for any commercial or other purpose whatsoever, without compensation to the user or any other person sending the submission. The user acknowledges that it owns whatever material is submitted, and use of any submission by HSFA will not infringe or violate the rights of any third party.

Disclaimers

Materials are provided “as is” without warranty of any kind, either express or implied, including, without limitation, warranties of merchantability, fitness for a particular purpose and non-infringement. HSFA specifically does not make any warranties or representations as to the accuracy or completeness of any such materials. HSFA frequently adds, changes, improves or updates the materials without notice. Further, HSFA does not warrant or make any representations regarding the use or the result of the use of materials in terms of correctness, accuracy, reliability or otherwise.

These materials may include technical inaccuracies or typographical errors. HSFA may make changes or improvements at any time.

Terminations

HSFA or the user may terminate this agreement at any time. This agreement may be terminated by the user destroying all materials obtained at this site and elsewhere from HSFA and all related documents and copies and installations. HSFA may terminate this agreement immediately without notice, if in its sole judgment, any breach of this agreement and its terms have occurred. Upon termination, all materials must be destroyed.

Applicable Laws and Jurisdictions

These Terms of Use and any amendments or revisions shall be governed by applicable federal law and the laws of the State of Georgia, without regard to its conflict of laws principles. Any case, controversy, suit, action, or proceeding arising out of, in connection with, or related to these Terms & Conditions shall be brought in the appropriate federal court located in the State of Georgia.

Policy No. GF-EP-G10000 - Board of Directors Operations Manual

| Policy Title: | Board of Directors Operations Manual | |

| Policy Number: | GF-EP-G10000 | |

| Current Version Number: | 2.0 | |

| Version Effective Date: | 31 January 2017 | |

| Reference Documents: | HSFA Policy and Procedure Manual. | |

| Revision History: | Prior Version Number | Effective To/From |

| Policy Owner: | HSFA Department of Administrative Services

Tel: 877-859-6850 Email: [email protected] |

|

| Functional Area: | X Administrative Finance

Governance X Board Operation Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

Policy Purpose

To ensure that the HSFA Board of Directors understand and accept their roles as the governing body of HSFA.

Policy Statement

The HSFA Board of Directors exist to ensure that HSFA is effective, efficient and accountable to the public, providing needed strategic vision and leadership, setting the tone from the top, establishing a compliant and ethical culture and providing services in an ethical and professional manner. The Board of Director’s Policy and Procedure Manual was formulated to provide information and direction regarding board selection, standards, operations, objectives, reporting, committees, expectations and conduct.

Policy GF-EP-G10001 - Compensation Arrangements –Directors, Officers and Employees

| Policy Title: | Compensation Arrangements – Directors, Officers and Employees | |

| Policy Number: | GP-EP-G10001 | |

| Current Version Number: | 2.0 | |

| Version Effective Date: | 1/30/2017 | |

| Reference Documents: | Bylaws, Article 4, Section 6 and Article 9, Section 5; Form 990, Schedule J; SOP No. GF-EP-G10038. | |

| Revision History: | Prior Version Number | Effective To/From |

| 1.0 | 9/8/2009 – 1/30/2017 | |

| Policy Owner: | HSFA Department of Administrative Services (DOAS)

ATTN: Governance and Finance Committee Tel: 877-859-6850 Email: [email protected] |

|

| Functional Areas: | Administrative Finance

Governance Board Operation Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

Policy Purpose

To prescribe the process for determination of (including standards) and the approval of compensation arrangements for directors, officers and employees in accordance with federal and state law, public policy and the corporation’s bylaws.

Policy Statement

Directors. In accordance with the Bylaws, Article 3, Section 6, directors shall serve without compensation with the exception of a fee for attendance at board meetings and for reimbursement of expenses incurred in connection with performance of duties.

President. The President’s compensation (as the corporation’s highest ranking executive officer) shall be determined utilizing the standards found in the Bylaws, Article 9, Section 5 and IRS Form 990, Schedule J. The President’s compensation arrangement shall be considered by the Governance and Finance Committee and submitted to the Board of Directors for approval. Appropriate documentation should be formulated in accordance with the Bylaws, Article 9, Section 5, Paragraph C.

Officers. Officers’ compensation shall be determined utilizing the standards found in the Bylaws, Article 9, Section 5. All officers’ (except the President’s) compensation arrangements shall be considered and approved by the Governance and Finance Committee. Appropriate documentation should be formulated in accordance with the Bylaws, Article 9, Section 5, Paragraph C.

Employees. Employees’ compensation shall be determined utilizing the standards found in the Bylaws, Article 9, Section 5. All employees’ compensation arrangements shall be approved by the corporation’s President. Appropriate administration, documentation, etc., shall be in accordance with guidelines formulated by the President.

Standard Operating Procedure (SOP) No. GF-EP-G10038 - Compensation Arrangements – Directors, Officers and Employees

Directors

Since directors serve without compensation, further direction is not required.

Reimbursement of expenses should be made to and require the approval of the corporation’s Chief Financial Officer (“CFO”), Treasurer or President. The process for submission of such requests should be made in accordance with normal procedures outlined by the Office of the President.

President

The compensation arrangement for the corporation’s ranking officer, currently utilizing the title President, requires approval of the Board.

Such vote shall be caused by the Board’s Governance and Finance Committee (“Committee”). The Committee shall consider the proposed compensation arrangement and make a recommendation to the Board.

A majority vote is required for the Committee to send a recommendation to the Board.

The Committee shall consider the following in arriving at a recommendation:

- Compensation levels paid by similarly situated organizations, both taxable and tax-exempt, for functionally comparable positions. “Similarly situated” organizations are those of a similar size, purpose, and with similar resources. The Committee may utilize nternal and external salary surveys, studies, information, etc., as it so determines to be necessary to make such comparisons.

- The availability of similar services in the geographic area of HSFA (currently the greater Atlanta, Georgia metropolitan area).

- The Form 990’s from other non-profit corporations.

- Current compensation surveys compiled by independent firms.

- The opinion of an independent salary consultant.

- Actual written offers from similar institutions competing for the services of the person who is the subject of the compensation arrangement.

Upon receipt of the Committee recommendation the Board’s secretary shall schedule the recommendation for consideration. Such meeting (regular or special) should be scheduled within a reasonable time.

The President shall not be in attendance. The meeting shall be chaired by the Board’s vice-chairman.

The Committee’s recommendation shall include the following:

- The name of the individual.

- The terms of the compensation package, i.e., salary.

- The information utilized in arriving at the recommendation.

- Any other pertinent information, justification, reasoning, documentation, etc., so utilized.

Following active contemporaneous debate and upon proper motion, the Board shall vote on the recommendation. A majority vote is required for approval.

The action of the Board shall be recorded and the permanent record shall be maintained by the corporation’s CFO. The record should include the following:

- The terms of the compensation arrangement and the date it was approved.

- The members of the Board who were present during debate on the transaction, those who voted on it, and the votes cast by each board or committee member.

- The comparability data obtained and relied upon and how the data was obtained.

- If the Board determines that reasonable compensation for a specific position in this organization or for providing services under any other compensation arrangement with this organization is higher or lower than the range of comparability data obtained, the Board or committee shall record in the minutes of the meeting the basis for its determination.

- If the Board makes adjustments to comparability data due to geographic area or other specific conditions, these adjustments and the reasons for them shall be recorded in the minutes of the Board.

- Any actions taken with respect to determining if a Board member had a conflict of interest with respect to the compensation arrangement, and if so, actions taken to make sure the member with the conflict of interest did not affect or participate in the approval of the transaction (for example, a notation in the records that after a finding of conflict of interest by a member, the member with the conflict of interest was asked to, and did, leave the meeting prior to a discussion of the compensation arrangement and a taking of the votes to approve the arrangement).

Upon receipt of the action, the CFO shall take action to effectuate in a timely fashion as instructed by the action.

Officers

Compensation arrangements for officers, other than the President, require approval by the Committee (a duly constituted committee of the Board). Board approval is not required.

Such vote shall be caused by submission of request to the Committee Chair at least 10 days prior to date approval is sought.

Upon receipt the Chair will call a meeting of the Committee.

The Committee shall consider (if available and applicable) the following in arriving at a decision.

- Compensation levels paid by similarly situated organizations, both taxable and tax-exempt, for functionally comparable positions. “Similarly situated” organizations are those of a similar size, purpose, and with similar resources. The Committee may utilize internal and external salary surveys, studies, information, etc., as it so determines to be necessary to make such comparisons.

- The availability of similar services in the geographic area of HSFA where the officer will perform the majority of his/her services.

- The Form 990’s from other non-profit corporations.

- Current compensation surveys compiled by independent firms.

- The opinion of an independent salary consultant.

- Actual written offers from similar institutions competing for the services of the person who is the subject of the compensation arrangement.

Following active contemporaneous debate and upon proper motion, the Committee shall vote on the recommendation. A majority vote is required for approval.

The action of the Committee shall be recorded and the permanent record shall be maintained by the corporation’s CFO. The record should include the following:

- The name of the individual officer.

- The terms of the compensation arrangement and the date it was approved.

- The members of the Committee who were present during debate on the transaction, those who voted on it, and the votes cast by each board or committee member.

- The comparability data obtained and relied upon and how the data was obtained.

- If the Committee determines that reasonable compensation for a specific position in this organization or for providing services under any other compensation arrangement with this organization is higher or lower than the range of comparability data obtained, the Board or committee shall record in the minutes of the meeting the basis for its determination.

- If the Committee makes adjustments to comparability data due to geographic area or other specific conditions, these adjustments and the reasons for them shall be recorded in the minutes of the Committee.

- Any other pertinent information, justification, reasoning, documentation, etc., so utilized.

- Any actions taken with respect to determining if a Committee member had a conflict of interest with respect to the compensation arrangement, and if so, actions taken to make sure the member with the conflict of interest did not affect or participate in the approval of the transaction (for example, a notation in the records that after a finding of conflict of interest by a member, the member with the conflict of interest was asked to, and did, leave the meeting prior to a discussion of the compensation arrangement and a taking of the votes to approve the arrangement).

Upon receipt of the action, the CFO shall take action to effectuate in a timely fashion as instructed by the action.

Employees

Compensation arrangements for all employees require the approval of the corporation’s President.

The President shall consider (if available and applicable) the following in arriving at a decision.

- Compensation levels paid by similarly situated organizations, both taxable and tax-exempt, for functionally comparable positions. “Similarly situated” organizations are those of a similar size, purpose, and with similar resources. They may utilize internal and external salary surveys, studies, information, etc., as it so determines to be necessary to make such comparisons.

- The availability of similar services in the geographic area of HSFA where the employee will perform the majority of his/her services.

- The Form 990’s from other non-profit corporations.

- Current compensation surveys compiled by independent firms.

- The opinion of an independent salary consultant.

- Actual written offers from similar institutions competing for the services of the person who is the subject of the compensation arrangement.

The President may consider other information in addition to the above as deemed necessary in execution of his/her responsibilities.

The day-to-day administration of employee compensation arrangements rest solely with the President or his/her representative to whom such authority is duly and properly delegated.

The day-to-day administration and maintenance of all employee compensation arrangements shall occur in accordance with guidelines formulated and managed by the President or his/her representative to whom such authority is duly and properly delegated.

Policy No. GF-EP-G10002 - Conflict of Interest (Directors, Officers, Designated Employees and Disqualified Persons)

| Policy Title: | Conflict of Interest (Directors, Officers, Designated Employees and Disqualified Persons) | |

| Policy Number: | GF-EP-G10002 | |

| Current Version Number: | 2.0 | |

| Version Effective Date: | 1/31/2017 | |

| Reference Documents: | Bylaws, Article 9, Sections 1-4 and Section 6; Form No. GF-EP-G10053 (Acknowledge); Form No. GF-EP-G10054 (Disclosure); SOP No.GF-EP-G10039. | |

| Revision History: | Prior Version Number | Effective To/From |

| 1.0 | 9/8/2009 – 1/30/2017 | |

| Policy Owner: | Name: HSFA Department of Administrative Services (DOAS)

Tel: 877-859-6850 Email:[email protected] |

|

| Functional Area: | Administrative Finance

Governance Board Operation Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

| Policy Purpose |

| To protect HSFA’s interest when it is contemplating entering into a transaction or arrangement that might benefit the private interest of Board members, officers and/or employees (as determined by the HSFA President and general counsel) of the corporation or any disqualified person as defined in Section 4958(f)(1) of the Internal Revenue Code and as amplified by Section 53.4958-3 of the IRS Regulations and which might result in a possible excess benefit transaction, as defined in Section 4958(c)(1)(A) of the Internal Revenue Code and as amplified by Section 53.4958 of the IRS Regulations.

This policy is intended to supplement but not replace any applicable state and federal laws governing conflict of interest applicable to HSFA. |

| Policy Statement |

| HSFA will not permit transactions involving Board of Directors, officers and designated employees (as determined by the HSFA President and general counsel) or disqualified persons that result in a conflict of interest. Further, if a Board member, officer or designated employee (as determined by the HSFA President and general counsel) or disqualified persons enters into such a transaction appropriate disciplinary action will be taken. |

SOP No. GF-EP-G10039 - Conflict of Interest (Board members, Officers, Designated Employees* and Disqualified Persons)

Definitions

Interested Person. Any Board member, officer, member of a committee with governing board delegated powers, any designated employee, or any other person who is a disqualified person as defined in Section 4958(f)(1) of the Internal Revenue Code and as amplified by Section 53.4958-3 of the IRS Regulations, who has a direct or indirect financial interest, as defined below, is an interested person.

Financial Interest. A person has a financial interest if the person has, directly or indirectly, interest through business, investment, or family:

- An ownership or investment interest in any entity with which the corporation has a transaction or arrangement.

- A compensation arrangement with the corporation or with any entity or individual with which the corporation has a transaction or arrangement.

- A potential ownership or investment interest in, or compensation arrangement with, any entity or individual with which the corporation is negotiating a transaction or arrangement.

Compensation includes direct and indirect remuneration as well as gifts or favors that are not insubstantial.

A financial interest is not necessarily a conflict of interest. Under Section 3, paragraph B, a person who has a financial interest may have a conflict of interest only if the appropriate governing board or committee decides that a conflict of interest exists.

* Note: By adoption of Policy No. GF-EP-E10002, the Board permits application of the Bylaw requirement to employees designated by the HSFA President and general counsel. Currently, designated employees include all HSFA non-officers at director level and above.

Conflict of Interest Avoidance Procedures

Duty to Disclose. In connection with any actual or possible conflict of interest, an interested person must disclose the existence of the financial interest and be given the opportunity to disclose all material facts to the Board and members of committees with governing board delegated powers considering the proposed transaction or arrangement.

Step 1: Interested persons with possible conflicts shall notify the Governance and Finance Committee (“Committee”) chair. A meeting of the Committee will be called within 10 days of such notification. The reporting person will be invited and provided the opportunity to discuss the matter.

Determining Whether a Conflict of Interest Exists. After disclosure of the financial interest and all material facts, and after any discussion with the interested person, he/she shall leave the governing board or committee meeting while the determination of a conflict of interest is discussed and voted upon. The remaining board or committee members shall decide if a conflict of interest exists.

Procedures for Addressing the Conflict of Interest. An interested person may make a presentation at the governing board or committee meeting, but after the presentation, he/she shall leave the meeting during the discussion of, and the vote on the transaction or arrangement involving the possible conflict of interest.

Step 2: At the conclusion of the discussion the reporting will be asked to leave the Committee meeting. The members of the Committee shall consider the matter and by vote decide if a conflict of interest exists.

The chairperson of the governing board or committee shall, if appropriate, appoint a disinterested person or committee to investigate alternatives to the proposed transaction or arrangement.

After exercising due diligence, the governing board or committee shall determine whether the corporation can obtain with reasonable efforts a more advantageous transaction or arrangement from a person or entity that would not give rise to a conflict of interest.

Step 3: The Committee, with possible support from others, will decide and review possible alternatives that do not result in a conflict of interest.

If a more advantageous transaction or arrangement is not reasonably possible under circumstances not producing a conflict of interest, the governing board or committee shall determine by a majority vote of the disinterested Board members, whether the transaction or arrangement is in the corporation’s best interest, for its own benefit, and whether it is fair and reasonable. In conformity with the above determination, it shall make its decision as to whether to enter into the transaction or arrangement.

Step 4: The Committee chair shall communicate the results to the reporting person.

Violations of the Conflicts of Interest Policy

If the governing board or committee has reasonable cause to believe a member has failed to disclose actual or possible conflicts of interest, it shall inform the member of the basis for such belief and afford the member an opportunity to explain the alleged failure to disclose.

If, after hearing the member’s response and after making further investigation as warranted by the circumstances, the governing board or committee determines the member has failed to disclose an actual or possible conflict of interest, it shall take appropriate disciplinary and corrective action.

Note: Such violations will be considered by the Governance and Finance Committee. The Committee shall make a recommendation for appropriate action.

Records of Board and Board Committee Proceedings

The minutes of meetings of the governing board and all committees with board delegated powers shall contain:

- The names of the persons who disclosed or otherwise were found to have a financial interest in connection with an actual or possible conflict of interest, the nature of the financial interest, any action taken to determine whether a conflict of interest was present, and the governing board’s or committee’s decision as to whether a conflict of interest in fact existed.

- The names of the persons who were present for discussions and votes relating to the transaction or arrangement, the content of the discussion, including any alternatives to the proposed transaction or arrangement, and a record of any votes taken in connection with the proceedings.

Note: These minutes shall result from the Governance and Finance Committee proceedings. The minutes shall be forwarded to the corporation’s Secretary for safekeeping.

Annual Statements

Each Board member, principal officer, and member of a committee with governing board delegated powers shall annually sign a statement which affirms such person:

- Has received a copy of the conflicts of interest policy.

- Has read and understands the policy.

- Has agreed to comply with the policy.

- Understands the corporation is charitable and in order to maintain its federal tax exemption it must engage primarily in activities which accomplish one or more of its tax-exempt purposes.

Note: The Quarterly Disclosure Form. (No. GF-EP-E10054) shall be collected by end of each quarter. The Acknowledge Form (No. GF-EP-G10053) shall be collected upon receipt of the policy. These statements shall be collected by the HSFA Vice President. After review, unless a conflict is reported, the forms shall be forwarded to the corporation’s Secretary for safekeeping. Any reported conflicts shall be forwarded to the Governance and Finance Committee chair for appropriate consideration by the Committee.

Note: Adherence to the Conflict of Interest Policy and SOP is monitored as part of the HSFA compliance program.

Dated: October 17, 2009

Document No. GF-EP-G10039

Conflict of Interest Acknowledgement Form

Conflict of Interest Disclosure Form

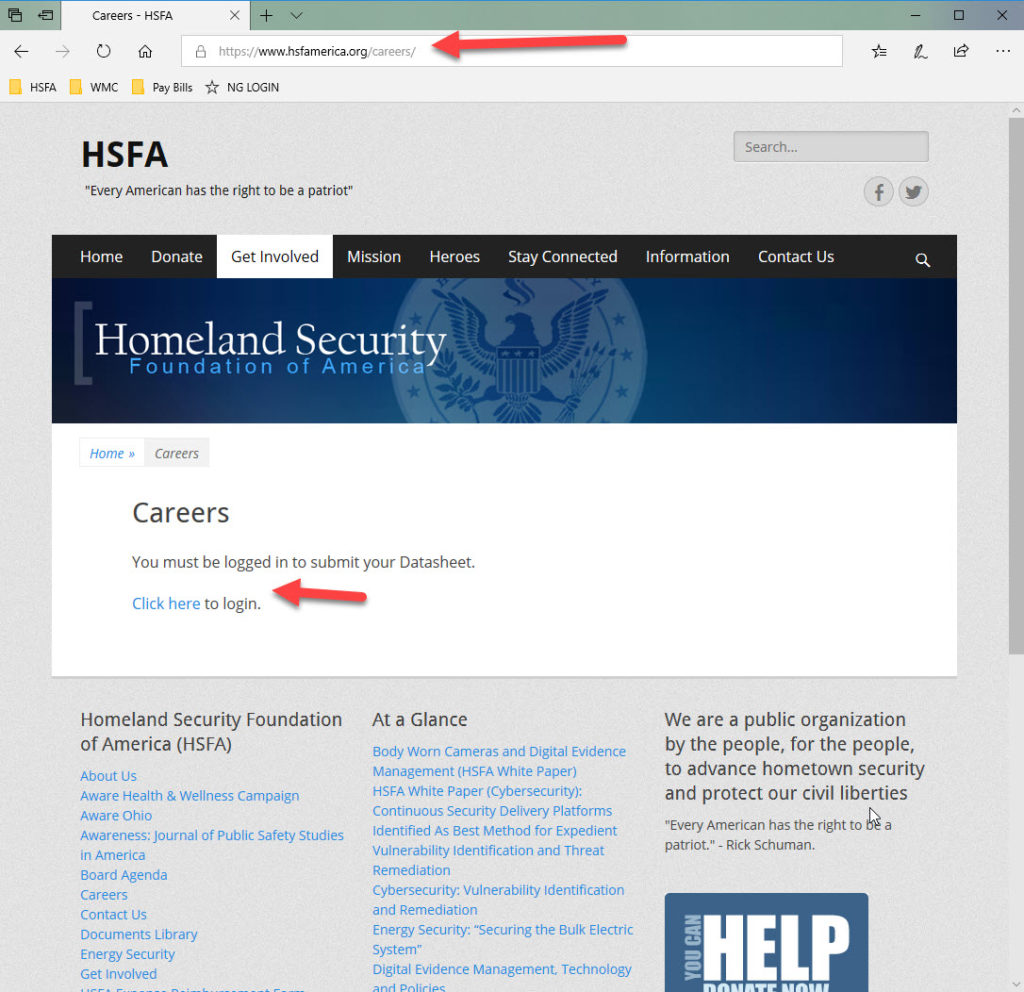

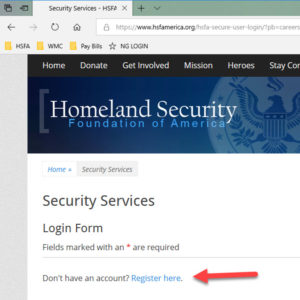

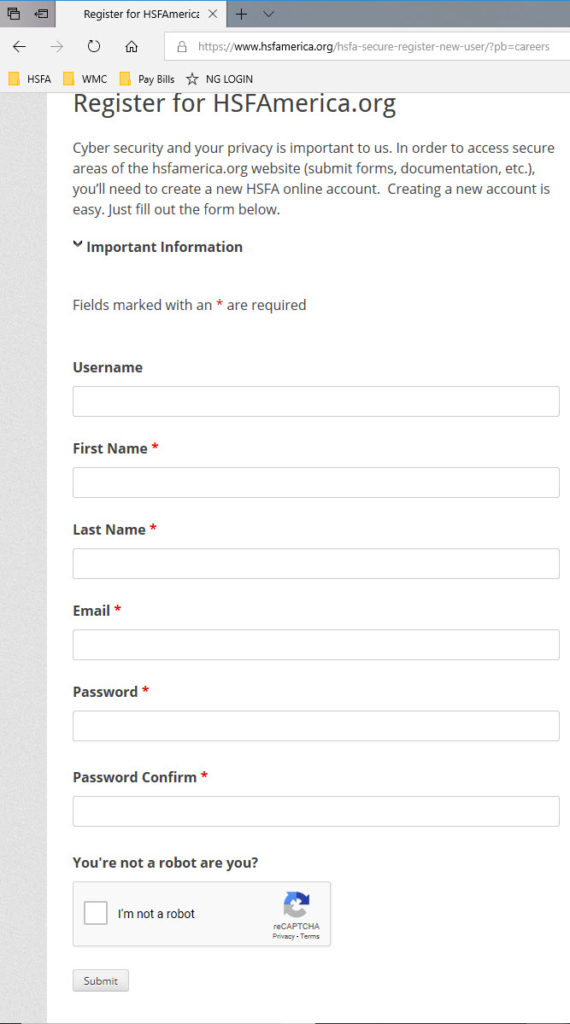

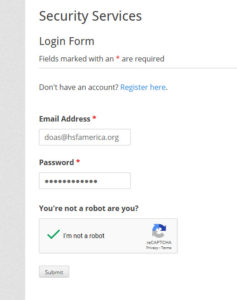

You must be logged in to submit your Conflict of Interest Disclosure Form.

Click here to login.

Policy No. GF-EP-G10003 - Disclosure and Availability of Records to the General Public

| Policy Title: | Disclosure and Availability of Records to the General Public | |

| Policy Number: | GF-EP-G10003 | |

| Current Version Number: | 2.0 | |

| Version Effective Date: | 1/31/2017 | |

| Reference Documents: | IRC Section 501(c)(3), IRS Reg. Section 301.6104 (d) -1 through -3; Sarbanes-Oxley; SOP No. GF-EP-G10037. | |

| Revision History: | Prior Version Number | Effective To/From |

| 1.0 | 9/8/2009 – 1/30/2017 | |

| Policy Owner: | Name: HSFA Department of Administrative Services (DOAS)

Tel: 877-859-6850 Email: [email protected] |

|

| Functional Area: | X Administrative Finance

X Governance Board Operation Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

| Policy Purpose |

| To ensure disclosure and availability of all records as required under federal and state law and under public policy. |

| Policy Statement |

| HSFA as a public non-profit organization, created “of the people, by the people and for the people” discloses and makes available the following records to the general public.

Formation Information — (1) Organizing Document: Georgia Certificate of Restated Articles; (2) Form 1023: Application for Recognition of Exemption under Section 501(c) (3) of the Internal Revenue Code; (3) Attachments and IRS correspondence to Form 1023; and (4) IRS Section 501(c)(3) Determination Letter. Governing Documents – (1) Georgia Amended and Restated Articles of Incorporation of The Homeland Security Foundation of America, Inc.; (2) Amended and Restated Bylaws of the Corporation; (3) Policy and Standard Operating Procedure (“SOP”) – Conflict of Interest; (4) Policy and SOP – Records Retention and Document Destruction; and (5) Policy and SOP – Disclosure and Availability of Records to the General Public. Financial Information – (1) Annual Operating Budgets – 2010 and forward; and (2) Financial Statements – 2010 and forward. Tax Records – (1) Annual Tax Filings, Form 990EZ and Form 990 – 2009 and forward; (2) Supporting Schedules and Attachments to Form 990EZ and Form 990 except Schedule B: Names and Addresses of Contributors – 2009 and forward. Requests should be made under the guidelines provided in the SOP on Disclosure and Availability of Records to the General Public. |

SOP No. GF-EP-G10037 - Disclosure and Availability of Records to the General Public

Background

The IRC and Reg. Sections 301.6104(d) -1 through -3 require HSFA to disclose and make available specified tax information.

The Sarbanes-Oxley Act (“SOX”) requires corporations to publicly release financial statements and other financial information. While these provisions do not apply directly to tax-exempt organizations, HSFA has adopted SOX as “best practices” and adheres to the provisions.

HSFA as a public non-profit organization, created “of the people, by the people and for the people” has adopted the following standards and procedures regarding the disclosure and availability of records to the general public.

Records Available

Formation Information — (1) Organizing Document: Georgia Certificate of Restated Articles; (2) Form 1023: Application for Recognition of Exemption under Section 501(c) (3) of the Internal Revenue Code; (3) Attachments and IRS correspondence to Form 1023; and (4) IRS Section 501(c)(3) Determination Letter.

Governing Documents – (1) Georgia Amended and Restated Articles of Incorporation of The Homeland Security Foundation of America, Inc.; (2) Amended and Restated Bylaws of the Corporation; (3) Policy and Standard Operating Procedure (“SOP”) – Conflict of Interest; (4) Policy and SOP – Records Retention and Document Destruction; and (5) Policy and SOP – Disclosure and Availability of Records to the General Public.

Financial Information – (1) Annual Operating Budgets – 2010 and forward; and (2) Financial Statements – 2010 and forward.

Tax Records – (1) Annual Tax Filings, Form 990EZ and Form 990 – 2009 and forward; (2) Supporting Schedules and Attachments to Form 990EZ and Form 990 except Schedule B: Names and Addresses of Contributors – 2009 and forward.

Note: HSFA has not, nor is required to file IRS Form 990-T. When and if HSFA should be required to file in the future, Form 990-T will be disclosed and made available.

How to Request Inspection and/or Copies

- Visit the HSFA website at http://www.hsafmerica.org. The records are found at the Public Records page/tab. They can be inspected and printed.

- Mail a request to inspect records or a request for copies to: The Homeland Security Foundation of America, P.O. Box 2331, Powder Springs, GA 30127.

- Request inspection or copies by telephone at 1-877-859-6850.

- Request inspection or copes by facsimile at 1-888-308-0586.

- Request inspection or copies by email at [email protected]

Note: All requests should include the: (1) Name of the requestor; (2) A list of the records requested and (3) The address the records should be sent to.

How Requests Will be Responded To

- Mailed requests to inspect records: Arrangements will be made for viewing of records within fourteen (14) days of the receipt of the request or requested records will be mailed within fourteen (14) days of the request.

- Mailed requests for copies of records: Copies will be mailed within thirty (30) days of the date of receipt.

- Telephone request to inspect records: Arrangements will be made for viewing of records within 14 days of the receipt of the request or requested records will be mailed within 14 days of the request.

- Telephone for copies of records: Copies will be mailed within thirty (30) days of the date of receipt.

- Facsimile requests to inspect: Arrangements will be made for viewing of records within fourteen (14) days of the receipt of the request or requested records will be mailed within fourteen (14) days of the request.

- Facsimile requests for copies: Copies will be mailed within thirty (30) days of the date of receipt.

- Email requests to inspect: Arrangements will be made for viewing of records within fourteen (14) days of the receipt of the request or requested records will be mailed within fourteen (14) days of the request.

- Email requests for copies: Copies will be mailed within 30 days of the date of receipt.

Note: While HSFA will comply with all written, mailed, facsimile and emails requests, HSFA strongly encourages inspection and copying from its website at https://www.hsfamerica.org.

Other Information

HSFA has procedures to ensure reliability and accuracy of the documents posted on its website.

HSFA takes precautions to prevent alteration, destruction or accidental loss of all documents.

At an onsite inspection an HSFA employee will be present at all times. The individual inspecting will be allowed to take notes and make copies at no charge with their own photocopying equipment.

If HSFA makes copies a reasonable charge for copying may be incurred.

If HSFA mails copies a fee to cover the actual postage may be incurred.

Deemed dates of receipt: Request by mail – Seven days after the postmark date; Request by email—the date the email was sent; Request by telephone – the date of the telephone call.

HSFA maintains a log of requests including the name of requestor, the records requested and the timeframe/method of HSFA compliance with the request.

Any and all inquiries, concerns, complaints can be sent to:

Alpharetta, GA 30005

EIN: 14-1855787

Policy No. GF-EP-G10020 - Employee Manual

| Policy Title: | HSFA Employee Handbook | |

| Policy Number: | GF-EP-G10020 | |

| Current Version Number: | ||

| Version Effective Date: | ||

| Reference Documents: | HSFA Policy and Procedures Manual. | |

| Revision History: | Prior Version Number | Effective To/From |

| Policy Owner: | Name: Department of Administrative Services (DOAS)

ATTN: Chief Financial Officer / Treasurer Tel: 877-859-6850 Email: [email protected] |

|

| Functional Area: | X Administrative Finance

Governance Board Operation Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

| Policy Purpose |

| To ensure officer and employee knowledge of all HSFA employee policies, procedures, practices and standards. |

| Policy Statement |

| HSFA is committed a positive workplace environment with well-informed employees. The HSFA Employee Handbook provides necessary tools, information, policy and procedures for all officers and employees. |

Policy No. GF-EP-G10004 - Financial Accounting Manual

| Policy Title: | Financial Accounting Manual | |

| Policy Number: | GF-EP-G10004 | |

| Current Version Number: | 1.0 | |

| Version Effective Date: | 3/6/2017 | |

| Reference Documents: | HSFA Policy and Procedure Manual. | |

| Revision History: | Prior Version Number | Effective To/From |

| Policy Owner: | Name: Department of Administrative Services (DOAS)

ATTN: Chief Financial Officer / Treasurer Tel: 877-859-6850 Email: [email protected] |

|

| Functional Area: | X Administrative X Finance

X Governance Board Operation Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

| Policy Purpose |

| To ensure that the all financial and accountings standards and practices are complied with. |

| Policy Statement |

| HSFA operates on a day-to-day basis and maintains its financial and accounting records and books in accordance with federal and state laws and in accordance with all industry standards and practices. The Financial Accounting Manual along with its associated documents provides in detail HSFA procedures. |

Policy No. GF-EP-G10025 - Fiscal Sponsorships

| Policy Title: | Fiscal Sponsorships | |

| Policy Number: | GF-EP-G10025 | |

| Current Version Number: | 2.0 | |

| Version Effective Date: | 1/31/2017 | |

| Reference Documents: | ||

| Revision History: | Prior Version Number | Effective To/From |

| 1.0 | 9/8/2009 – 1/30/2017 | |

| Policy Owner: | Department of Administrative Services (DOAS)

ATTN: Vice President and Chief of Staff Tel: 877-859-6850 Email: [email protected] |

|

| Functional Area: | Administrative Finance

Governance Board Operation Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

| Policy Purpose |

| To ensure knowledge and to provide guidelines for Fiscal Sponsorship participation. |

| Policy Statement |

| HSFA no longer participates in Fiscal Sponsorships. |

Policy No. GF-EP-G10023 - Fundraising

| Policy Title: | Fundraising | |

| Policy Number: | GF-EP-G10023 | |

| Current Version Number: | 2.0 | |

| Version Effective Date: | 1/31/2017 | |

| Reference Documents: | IRS Form 990, Schedules B, G & M. | |

| Revision History: | Prior Version Number | Effective To/From |

| 1.0 | 9/8/2009 – 1/30/2017 | |

| Policy Owner: | Name: Department of Administrative Services (DOAS)

Title: Vice President Tel: 877-859-6850 Email: [email protected] |

|

| Functional Area: | Administrative Finance

Governance Board Operation Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

| Policy Purpose |

| To ensure that fundraising solicitations meet federal and state law requirements; to ensure solicitation materials are accurate, truthful, and candid; to ensure fundraising costs are reasonable; to ensure one hundred percent (100%) board member participation in fundraising; and to ensure information about HSFA fundraising costs and practices is available to donors and the public. |

| Policy Statement |

| Charitable fundraising is an important source of financial support for HSFA. All donations solicited on behalf of the organization shall be used to further this mission. Funds shall be solicited in a respectful manner and without pressure. All third parties not directly affiliated with HSFA who wish to solicit funds on behalf of the organization must acquire written permission from HSFA and must be registered with the state prior to beginning any fundraising/solicitation activities. Solicitors/fundraisers MUST comply with all HSFA policies and procedures and local, state and Federal laws regarding charitable solicitations and fundraising. Failure to do so may result in legal action and/or criminal prosecution. HSFA as an IRC Sec. 501(c)(3) non-profit public charity, all contributions made to the organization are tax deductible to the fullest extent of the law. Donations are not returnable.

|

| Board Member Donations |

| Board members need to give more than just their time. They need to give money to the organization, regardless of how much time they donate, and regardless of how little means they have to donate cash.

Board Member Annual Cash Donation (required) Each member of the board shall make an annual cash donation to the organization. Board members will be expected to give to the best of their means, at a level they would consider generous; however, board members must donate a minimum of twenty-five U.S. dollars ($25 USD) cash to the organization to be in compliance for the year. The due date for the Annual Cash Donation is 31 January of each fiscal year or upon thirty (30) calendar days after being elected to the board. Invoices will be sent to each board member. Board Members, who do not meet the deadline for the Annual Cash Donation will go into Inactive Status immediately and be subject to termination by the Chairman if inactive for three (3) consecutive regular board meetings. The Chairman, at his/her discretion may make a board member that is inactive, due to noncompliance to this policy, active again, provided the board member makes the required Annual Cash Donation prior to requesting reactivation. Board Member External Donations (optional) In addition to the required Annual Cash Donation, board members are encouraged to bring one or more donors to HSFA that contributed a combined minimum of five-thousand U.S. dollars ($5,000 USD) annually. Privacy There is no reason for other board members to know the donation level for each board member; it is enough for the board to know 100% of the board has given to the best of their means. As a part of each regular board member, the Chairman will report the status of board member giving, e.g., 100% board giving has/has not been met. |

A Primer on Fundraising

Fundraising is the life blood of a non-profit organization. At the Homeland Security Foundation of America (HSFA), board of directors members must all participate in fundraising in order for the organization to ask for grants from grant-making organizations. In addition to 100% board participation in fundraising, meaning each board member must comply with the then approved fundraising policy, board members are encouraged to seek out other sponsors for the organization. This primer is designed to help directors succeed in brining donors to HSFA.

Raising Money for your Non-profit

Research

The first step of research is to find out how much you need to raise. Once that need is determined, it’s important to research how many gifts you’ll need. If you’re attempting to raise $100,000, the knee-jerk reaction will probably be “We just need to find 100 people that will give us $1,000.” As nice as that seems, decades of fundraising experience show that that simply isn’t how it works.

One of the most helpful tools is a gift grid. A free online version can be found at sites like Blackbaud.com. Long-standing common wisdom shows that you’ll need at least one gift equaling 10% of the total. The next two should equal 5% of the total, etc.

So, to reach your goal of $100,000, you’ll need at least one donor to give a minimum of $10,000. Experience shows that you’ll need to have 4 or 5 prospects to achieve that gift. Work through the grid until you have names of prospects for each level.

As you’re building your prospect list, you’ll want to continue your research. Google can be an incredibly helpful tool. So can your board members and a development committee in the form of a peer review committee. You could invite these people, remind them of your cause and fundraising goals, and ask them to go over the names of prospects.

One simple method of doing this is conducting what I call a “CPI screening”: rating each prospect on CAPACITY, PHILANTHROPY, and INTEREST.

- Does the prospect have CAPACITY—are they financially able to make a gift?

- Are they PHILANTHROPIC—are they generous with their money. You need to be a good steward of your resources, if the prospect can’t make a worthwhile gift or doesn’t have a track record of giving you would be better served seeking donations elsewhere.

- Are they INTERESTED in your cause? You can find this out by looking at other causes they’ve supported and by asking people close to your organization.

Have the people on the committee assign a score of 1-5 for each category—1 being lowest, 5 being highest. This is tool can be useful because it removes individual personalities from the prospect rating process and makes it feel more objective. You should promptly visit anyone scoring 12 or more. But watch for those with high scores in the first two categories and some inclination to your cause. While you can’t make someone more wealthy or generous, but you can have a chance at making someone more interested in your organization.

ENGAGE

I like to think of this as the dating part of the relationship. It’s important to get to know your prospects before you “pop the question.” While you’ll certainly want to share the story of your cause, take time to get to know them—listen to their story, discover their interests, hear their goals. If they prospect has C and P then here’s where you work on I.

ASK

The number one reason people don’t give money to your cause is that they are not asked. Even if you skip the prior two steps, you’ll still reach some level of success by consistently executing this one.

If you’ve done the first two steps, this step will be quite fun. You’ll already have the odds in your favor. You know that they are predisposed to saying “yes” and you’ll have had time to shape the ask around their passions.

I recommend asking people for gifts spread out over a period of time: i.e. “$1000 a year for three years.” This both shows you consider your cause important enough for a substantial investment and it saves you from having to ask them again and again.

LOVE

I originally called this step Live/Like/Love. This is easy if the prospect says

“yes” when you’ve asked. You simply need to be sure to thank them about seven times before you ask them again.

10 Tips for Being a Good Fundraiser

Many people in the non-profit world tend to want to avoid fundraising, perhaps out of embarrassment, a sense of inadequacy, or fear of failure.

There are no magic formulas in fundraising.

It is, however, an inevitable part of the efforts of a non-profit. Becoming familiar with the fundamentals of fundraising and getting some practice at it are two steps that bring success. These ten basic tips can be useful in the necessary task of garnering funds for your organization.

10 FUNDRAISING TIPS

These are just some things to consider:

- Ask for a gift—don’t wait. Another will ask if you don’t.

- Look professional and act professionally.

- Be accountable for yourself and for your nonprofit.

- Be honest, and listen to your heart, because it is usually more honest than your mind.

- Speak with conviction for your cause.

- If you cannot speak with conviction and confidence, recruit someone who can.

- A prospect is simply a donor without motivation. You provide the motivation.

- A donor is a fundraiser who has yet to share their conviction with a friend. Ask them to.

- A good fundraiser, then, is a friendly motivator. It’s that simple.

- A successful fundraiser has thick skin, a soft heart, exceptional hearing, a quick mind, a slow tongue and no shame—at least when it comes to asking for a gift.

Ask: How to Ask Anyone for Any Amount, The

The Ask is a complete resource for teaching anyone—experienced in fundraising or not—how to ask individuals, in person, for a contribution to for a local nonprofit or a special event or community project, an enhanced annual gift, a major or planned gift, or a challenging capital campaign gift. Written by fundraising expert Laura Fredricks, The Ask shows what it takes to prepare yourself and others to make an effective ask and includes over one hundred sample dialogues you can use and adapt. Step by step, the book reveals how to listen, what to say, and how to follow up on each and every ask until you receive a solid and definitive answer. In addition, The Ask covers such topics as how to

- Examine your views on money before making an ask

- Learn the ins and outs of asking for money

- Work with others to make an ask

- Determine if you should or should not ask a friend, colleague, or peer for money

- Figure out how many asks you can do given your time constraints

- Deal effectively with all the responses you will get to an ask

Big Gifts for Small Groups http://www.amazon.com/exec/obidos/redirect?path=ASIN/1889102210&link_code=as2&camp=1789&tag=thepointsofli-20&creative=9325

Believing that other books already focus on higher sum gifts, the author wisely targets a range that has been neglected: $500 to $5,000. Why? Here’s what Robinson says:

- These gifts are large enough to justify the time it takes to develop a prospect list, prepare a letter, follow up with a phone call and visit the prospective donor.

- They’re small enough to include a wide range of prospects.

- They’re both modest enough to seem feasible to the novice, but also ambitious enough to make it worth their while.

- Taken in the context of a major gifts campaign, with a team of solicitors working together, gifts of $500 to $5,000 can add up to a lot of money.

Fifty-Three Ways for Board Members to Raise $1000

https://hsfa.sharefile.com/d-s8256d13c65941c9b

8ways to raise $2,500 (or more) in 10days (or less, sometimes) BY KIM KLEIN & STEPHANIE ROTH

https://hsfa.sharefile.com/d-sac5f07289464538b

The 10 Most Important Things You Can Know about Fundraising

Policy No. GF-EP-G10005 - Governance, Risk Management and Compliance (GRC)

| Policy Title: | Governance, Risk Management and Compliance (GRC) | |

| Policy Number: | GF-EP-G10005 | |

| Current Version Number: | 1.0 | |

| Version Effective Date: | 9/8/09 | |

| Reference Documents: | Primer and Statement on GRC No. GF-EP-G10034. A SOP does not exist; direction is provided by the Primer and Statement. | |

| Revision History: | Prior Version Number | Effective To/From |

| Policy Owner: | Department of Administrative Services (DOAS)

ATTN: General Counsel Tel: 877-859-6850 Email: [email protected] |

|

| Functional Area: | Administrative Finance

X Governance X Board Operation Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

| Policy Purpose |

| To establish the corporate culture and to set a management tone that ensures compliance with laws, rules, government (federal, state and local) regulations, public policy standards and internally generated standards such as policies and procedures, codes of conduct, etc. |

| Policy Statement |

| The Homeland Security Foundation of America (“HSFA”) greatly values its reputation for integrity and high ethical standards.

It is HSFA’s policy to comply with all laws, rules, government (federal, state and local) regulations, public policy standards and internally generated standards such as policies and procedures, codes of conduct, etc. HSFA relishes its motto “of the people, by the people and for the people,” and thereby conforms to the highest ethical standards in conducting its business and serving the American pubic. |

Primer and Statement No. GF-EP-G10034 - Governance, Risk Management and Compliance (GRC)

Background

The Homeland Security Foundation of America (“HSFA”) greatly values its reputation for integrity and high ethical standards.

It is HSFA’s policy to comply with all laws, rules, government (federal, state and local) regulations, public policy standards and internally generated standards such as policies and procedures, codes of conduct, etc.

HSFA relishes its motto “of the people, by the people and for the people,” and thereby conforms to the highest ethical standards in conducting its business and serving the American pubic.

To ensure, HSFA has adopted the integrated approach to governance, risk and compliance management. The GRC framework is comprised of:

Governance, which is the responsibility of the board of directors and HSFA officers. Governance focuses on creating organizational culture and establishing a tone by defining the mechanisms which are then utilized to ensure that HSFA adheres to all laws, rules, etc., and follows established processes and policies. HSFA has achieved a proper governance strategy that implements systems to monitor and records current business activity, that takes steps to ensure compliance with the agreed policies and procedures, and that provides for corrective action in cases where the rules have been ignored or misconstrued.

Risk Management, which is the process by which HSFA determines risk appetite and tolerance, identifies potential risks and prioritizes the tolerance for risk based on the HSFA’s business objectives. Risk Management leverages internal controls to manage and mitigate risk throughout HSFA.

Compliance, which is the process that records, monitors and reports the controls, be they physical, logical or organizational, needed to enable compliance with any and all laws, rules, regulation and policy that HSFA operates under including internal standards, policies and procedures..

Part 1 – Applicable Laws

The GRC framework for HSFA, as a non-profit, tax exempt organization, is constituted from these sources:

Provisions from the State of Incorporation. Includes applicable state constitutional, statutory and regulatory provisions, laws, rules, etc. Also includes all court case law and opinions. Generally speaking, these are the provisions which govern an organization’s formation, the board of directors, officers and other high level aspects of operation.

Other State Laws. Includes the laws, etc., of other states where sufficient activity is conducted to establish nexus.

Internal Revenue Code. The federal government has chosen to regulate tax exempt organizations via the Internal Revenue Code and other rules, regulations, etc. The Internal Revenue Service has articulated that 501(c)(3) organizations are subject to good governance principles. While they may not be expressly and specifically articulated within the IRC, such principles are derived from the tax exemption provisions. Much of the IRS’s view of GRC can be gleamed from the annual federal tax filing (Form 990), the instructions thereto and other IRS pronouncements.

Public Policy. Non-profit, tax exempt organizations are part of the independent sector, as contrasted to the business and governmental sectors. They are deemed to exist to serve the public interest and are subject to public policy principles.

Internally Generated Standards. HSFA has developed policies, procedures, guidelines, codes, standards, etc.

Part 2 – Governing Documents

Organizations, as has HSFA, interpret the direction and guidance provided by these sources and will generally establish a GRC framework with the following hierarchy of governing documents:

- Articles of Incorporation,

- Bylaws, and

- Policy and Procedures (commonly called standard operating procedures or SOPs).

Articles of Incorporation. The articles can be thought of as the organization’s contract with the state. The articles will generally reflect the minimum requirements under the state of incorporation’s provisions.

HSFA’s Articles of Incorporation were issued by the Secretary of State, State of Georgia, on October 1, 2007 and contain limited direction on the following:

- Name,

- Organizational Type,

- Duration Period,

- Organizational Purpose,

- Non-Profit Status,

- Board of Directors and Enactment of Bylaws,

- Debt Obligation and Personal Liability,

- Amendment of Articles, and

- Dissolution

HSFA’s Articles can only be amended submission of the amendments to the Secretary of State, State of Georgia.

HSFA’s Articles can be found at as a PDF available to the public at the HSFA website. Currently, the articles are permanently maintained by the Board Support office as delegated by the secretary.

Bylaws. Bylaws should reflect the culture, mission and strategic direction of the organization they govern. They should strike the appropriate balance between flexibility and specificity. They should be flexible enough to allow the corporation to achieve its mission without frequent amendment, but specific enough to provide structure and direction to the board, officers and employees for achieving the mission. Bylaws must be aligned with the organization’s articles of incorporation and follow the law of the state under which the organization is incorporated, federal law, as well as public policy.

The bylaws will necessarily be more specific than the articles, but may not contravene what is outlined in the articles of incorporation or conflict with the law of the state of incorporation. Bylaws should not overly restrict the organization’s ability to operate day-to-day and in the ordinary course of business. Moreover, the organization’s practices must match its bylaws. If they do not, either the bylaws or the organization’s practices must be amended to be consistent with each other.

HSFA’s Bylaws were last approved by the Board of Directors on September 8, 2009. With additional specificity, they:

- State the purpose of the organization,

- Provide basic rules for the composition and responsibilities of the board of directors and officers, including the number of board members and officers; qualifications, roles, authorizations, and method for election, removal and filling vacancies; terms; and meeting requirements,

- Identify and define standing committees of the board,

- Establish the method of creating other board committees and provide for the creation of advisory and ad hoc committees, groups and projects;

- Provide provisions on the execution of instruments, deposits and funds,

- Provide for maintenance of corporate records and issuance of reports,

- Include the tax exemptions requirements that HSFA operates under,

- Include compensation provisions,

- Set procedure for the manner in which the bylaws may be amended, and

- Include other provisions such as waiver of notice, indemnification and dissolution and conflict of interest.

HSFA’s Bylaws can be amended by majority vote of the board of directors

HSFA’s Bylaws can be found as a PDF document available to the public at the HSFA website. Currently, the bylaws are permanently maintained by the Board Support office as delegated by the secretary.

Policies and Procedures. Additional direction and guidance, that are generally specific in nature and implement the policies adopted by the board of directors, are contained in procedures, statements and guidelines. They tend be operational in nature detailing the organization’s rules governing day-to-day affairs and activities in the ordinary course of the business, thereby assuring compliance.

These documents are contained in a Policies and Standard Operating Procedures Manual. The SOP manual is maintained by the General Counsel’s office (via delegation authority from the secretary). As internal operational documents, they will not be made available to the public.

Part 3 – Implementation and Monitoring

HSFA has formulated its GRC framework through the adoption of articles, bylaws, policies and SOPs, and will maintain them in accordance with the following principles and philosophies:

- All GRC documents will be compliant and will be written to ensure compliance with all applicable state and federal laws as well as applicable public policy.

- All GRC documents will be aligned with, support and reflect the culture, mission and strategic direction of the organization

- While all GRC documents will be compliant, they will not unnecessarily restrict the authority of the board of directors and the officers, and will allow the organization to respond effectively in the environment under which it operates.

- The organization’s actual practices, actions, etc., will match, align and be taken in accordance with all governing documents.

- All GRC documents may contain forward looking statement intended to indicate the organization’s adoption of and adherence to public policy intentions and requirements.

The GRC framework is overseen by the board of directors through the Governance and Finance Committee. Adherence to the framework is the responsibility of the officers of HSFA under the authority to conduct the day-to-day affairs and the ordinary business of the organization.

The day-to-day managing resides with the General Counsel, and with the Chief Financial (“CFO”) for all financial policies and standards.

The framework includes a compliance monitoring program generally under direction of the General Counsel. Day-to-day financial compliance monitoring is the responsibility of the CFO. The CFO may rely on external audits and certifications.

The framework includes a number of avenues for direction and guidance and to report violations. These include a hardcopy process (utilizing prescribed forms), an email process at [email protected] and a telephone process by calling the Ethics Hotline at +1 (877) 859-6850.

Note: These processes are intended to supplement, not replace, the administrative chain of command, the Human Resource policies, or routine operational procedures. All directors, officers and employees are expected, in the normal course of business, to bring information regarding financial errors or omissions as well as suggestions for improving the GRC framework, financial reporting, etc., to appropriate personnel and authorities.

The GRC framework includes a risk mitigation process that mandates compliance with all laws, rules, regulations, policies and standard operating procedures. When the law, etc., is clear and absolute, the framework adopts a zero tolerance for noncompliance.

On the other hand, in many situations the requirements will be not be absolute. In those instances, good business practices, risk management process and the GRC framework requires identification of the risks, development of internal control strategies to mitigate these inherent risks and monitoring to ensure the residual risks are and remain within acceptable levels.

As part of its financial standards and policies HSFA will adhere to the applicable provisions of Sarbanes-Oxley (SOX). SOX provides “best practices” which HSFA has adopted as part of its financial compliance standards.

Dated: October 15, 2009

Document No. GF-EP-E10034

Policy No. GF-EP-G10006 - Independent Contractors

| Policy Title: | Independent Contractors | |

| Policy Number: | GF-EP-G-10006 | |

| Current Version Number: | 1.0 | |

| Version Effective Date: | 9/8/09 | |

| Reference Documents: | HSFA Policy and Procedures Manual, Board of Director’s Operating Manual, HSFA Financial Accounting Manual; all federal, state laws and public policy applicable to HSFA; SOP No. GF-EP-G10050; Workplace Code of Conduct and Ethics Disclosure Form No. GF-EP-E10052. | |

| Revision History: | Prior Version Number | Effective To/From |

| Policy Owner: | Department of Administrative Services (DOAS)

ATTN: Vice President – Chief of Staff Tel: 877-859-6850 Email: [email protected] |

|

| Functional Area: | X Administrative X Finance

Governance Board Operation Fundraising X Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

| Policy Purpose |

| The purpose of this policy is to ensure independent contractors hired by HSFA are properly engaged and classified. |

| Policy Statement | ||||||||||||

| HSFA, in the normal course of business, may use independent contractors. Proper worker classification is important. Misclassifying a worker can result in HSFA owing significant penalties, back taxes, and back pay. The correct classification is determined by two layers of definitions: federal and state, so both state and federal Department of Labor (DOL) regulations may apply. Independent contractors may be hired by the Office of the President . All contractors, including solicitor agents, must sign a independent contractor agreement prior to conducting any work for HSFA.

A typical misclassification scenario is that HSFA classifies a worker as an independent contractorwhen in fact the federal DOL, or state wage and hour laws would define that same worker as an employee.

PRACTICE POINTERS

The following chart explains the types of tests typically used by governmental agencies to determine whether someone is an independent contractor or an employee:

|

Best Practices for Classifying Workers

Although every situation will be a little different, there are some common characteristics of a contractor relationship. For example, a contractor will typically:

- Have a significant degree of control over how the work is performed (minimal direction by the employer)

- Provide their own equipment for the work

- Have multiple clients

- Set their own hours

- May hire and fire their own workers

- Operate as a “business” including a bank account separate from their personal account, have a federal tax ID number, and their own insurance.

You should always have a written agreement with an independent contractor. This agreement should specifically state that they are not an employee and that they are responsible for their own payroll taxes. I strongly recommend that you require the contractor have his or her own insurance.

You should also avoid treating the contractor like an employee. For example, independent contractors should not receive the types of benefits that employees often receive, such as paid time off or health insurance. While employees may require job training, independent contractors should come to the job already having the necessary skills and training. Contractors should not be using your nonprofit’s business cards, and if you give them an email address, consider using the word “contractor” in the address or specifying that the individual is a contractor in their signature line.

Policy No. GF-EP-G10024 - Investments

| Policy Title: | Investments | |

| Policy Number: | GF-EP-G10024. | |

| Current Version Number: | 2.0 | |

| Version Effective Date: | 1/31/2017 | |

| Reference Documents: | Bylaws Article 4, Section 8; Article 9, Sections 1-4; IRS Form 990. | |

| Revision History: | Prior Version Number | Effective To/From |

| 1.0 | 9/8/2009 – 1/30/2017 | |

| Policy Owner: | Name: Department of Administrative Services (DOAS)

ATTN: Chief Financial Officer / Treasurer Tel: 877-859-6850 Email: [email protected] |

|

| Functional Area: | Administrative X Finance

X Governance Board Operation X Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

| Policy Purpose |

| To ensure HSFA participates in only lawful and financially sound investments; to ensure steps to safeguard HSFA’s assets and to ensure HSFA’s tax exempt status is not affected by any investment arrangements. |

| Policy Statement |

| As a IRC Sec. 501(c)(3) non-profit public charity, HSFA adopted a process to make investment-related decisions with respect to assets of HSFA and its financial plans in compliance with the standards of fiduciary conduct prescribed in the Employee Retirement Income Security Act of 1974 (ERISA). The process includes the investment goals and objectives of the plan, sets out decision-making processes for selecting investments, and specifies the procedures and relevant measurement indexes to be used in assessing ongoing investment performance, in accordance with the stated investment objectives. The investment standards are used as the basis for measuring and evaluating future investment performance. The results are submitted quarterly, for review, to the Board of Director’s Investment Committee or another Board committee as so designated. |

Policy No. GF-EP-G10007 - Joint Ventures

|

Policy Title: |

Joint Ventures. |

|

|

Policy Number: |

GF-EP-G10007 |

|

|

Current Version Number: |

2.0 |

|

|

Version Effective Date: |

1/31/17 |

|

|

Reference Documents: |

|

|

|

Revision History: |

Prior Version Number |

Effective To/From |

|

1.0 |

9/8/2009 – 1/30/2017 |

|

|

|

|

|

|

|

|

|

|

Policy Owner: |

Department of Administrative Services (DOAS) ATTN: Vice President – Chief of Staff Tel: 877-859-6850 Email: [email protected] |

|

|

Functional Area: |

Administrative Finance Governance Board Operation Fundraising Project/Program |

|

|

Policy Authority |

Board Review: |

|

|

Board Approval: |

N/A |

|

|

Date: |

|

|

|

Resolution Number: |

|

|

|

Policy Purpose |

|

Reserved. |

|

Policy Statement |

|

HSFA currently, in the normal course of business, does not utilize joint ventures. A policy will be formulated when business necessitates prior to entering into such an arrangement. |

Policy No. GF-EP-G10008 - Legislative Activity, Lobbying and Solicitation of Funds

| Policy Title: | Legislative Activity, Lobbying and Solicitation of Funds | |

| Policy Number: | GF-EP-G10008 | |

| Current Version Number: | 2.0 | |

| Version Effective Date: | 1/31/17 | |

| Reference Documents: | IRS Publication 4221 – Compliance Guide for 501(c)(3) Public Charities; Form 990; Policy No.GF-EP-G10012; Primer and Statement No. GF-EP-10030. (Note: A SOP does not exist for this policy. Direction is contained within the Primer and Statement on Legislative Activity, Lobbying and Solicitation of Funds No. GF-EP-G10033) | |

| Revision History: | Prior Version Number | Effective To/From |

| 1.0 | 9/8/2009 – 1/30/2017 | |

| Policy Owner: | Department of Administrative Services (DOAS)

ATTN: Chairman and President Tel: 877-859-6850 Email: [email protected] |

|

| Functional Area: | Administrative Finance

Governance Board Operation Fundraising Project/Program |

|

| Policy Authority | Board Review: | Complete |

| Board Approval: | Voice Vote: YES | |

| Date: | 3/6/2017 | |

| Resolution Number: | HR20170306-001 | |

| Policy Purpose |

| To ensure that HSFA directors, officers and employees comply with the law, rules and regulations pertaining to legislative activity, lobbying and solicitation of funds. |

| Policy Statement |

| HSFA does not engage in prohibited political campaign activities. Limited legislative activities are permitted though the prior approval of the HSFA president is required. Solicitation of funds will occur, but only as permitted and in accordance with all laws, rules, standards and policies. |

Primer and Statement No. GF-EP-G10033 - Legislature Activity, Lobbying and Solicitation of Funds

Absolute Prohibition on Political Campaign Activity

HSFA, as a tax exempt organization, is prohibited from directly or indirectly participating in, or intervening in any political campaign on behalf of, or in opposition to a candidate for public office. This prohibition includes contributions to campaign funds or public statements on behalf of a candidate. Some activities, such as candidate appearances at HSFA fundraisers, may fall outside the definition of campaign activity. Consequently, such activities may be permitted. Such a determination is based on the facts and circumstances of each situation. Violation of this rule could result in revocation of tax-exempt status and/or imposition of certain excise taxes